To Overcome Structural Challenges, Buyside & Sellside Firms Must Learn to Love the Cloud

It was during a presentation by the makers of the popular app-based game Candy Crush Saga at a Cloud Provider event in 2017 that Vincent Grandjean began to formulate a vision of the future for fixed income market data. The game developers were storing 100bn data points on each player per day; and – while they were beginning to analyse the user data to gain insights into player behaviour – Grandjean knew that they could only just be scratching the surface of the information’s potential given that it already amounted to double-digit petabytes stored in the Cloud.

Soon after, Grandjean returned to his desk at Banco Santander where he and a team were more than halfway through the development of a project to build a digital platform for the institution that could internally manage its fixed income trading workflow impacted by the EU’s Markets in Financial Instruments Directive (MiFID II). The focus of the task was to aggregate trading data into a single repository.

However, as the team began to build analytics on top of the derived MiFID II compliance data, they realised that they were creating something new that no other institution of their size had at that time – a regulatory compliance machine that doubled as a data store which, when analytics interfaces were applied to it, could be used by the bank’s fixed income business to create a newfound advantage in secondary markets trading.

In this article – the first in a four-part series produced in partnership with data analytics provider Propellant.digital – GreySpark Partners explores how asset managers, investment banks, non-bank market-makers, trading venues and regulators can turn the operational problems associated with managing the mass of unorganised post-trade regulatory reporting data available to them into opportunities to resolve long-standing structural challenges associated with bonds and swaps trading.

A Far-from-Consolidated EU Post-trade Tape

Since MiFID II went fully live in 2018, the long-standing supposition held by EU financial markets participants was that an incumbent provider of market data – or a new one – would emerge and create a so-called consolidated tape. It was only as recently as March 2023, though, that the European Securities & Markets Authority (ESMA) began debating again the form and function of potential models for an equities market consolidated tape, with no mention of when work on a likewise feed of corralled bonds and swaps post-trade data might commence.

The lack of a fixed income post-trade tape in the EU is rapidly becoming problematic and, arguably, more urgent every year. In November 2022, for example, ESMA announced it was temporarily suspending the publication of the results of its quarterly assessment of bond liquidity and the systematic internaliser regime data for bonds due to “data quality issues.”

ESMA’s thinking in 2018 when MiFID II entered full go-live was that, by 2020, private entities would step up to build the data infrastructure necessary to collate and disseminate real-time or delayed trade and quote data from all trading venues in any given market. If no private venture was formulated by 2020 to launch an EU consolidated tape, then the regulator’s back-up plan was to launch a review process to ensure that “an effective and comprehensive consolidated tape is in operation as soon as possible.”

When Grandjean and his fellow founders of Propellant launched the Cloud-based analytics solution in 2021, the objective was not to create a consolidated tape for the EU’s fixed income market. Rather, the goal – inspired by Grandjean’s previous experience working for a variety of different investment banks – was simply to demonstrate to trading firms how publicly-available data like that generated by MiFID II post-trade reporting could be captured, organised and combined with internal proprietary data and advanced analytics to make the fixed income market more transparent (see Figure 1).

Propellant’s concept, while noble, is also hardly novel. Since the onset of the 2008 financial crisis and the resulting wave of re-regulation of global markets activity undertaken to prevent a similar set of events from occurring again, asset management firms and investment banks largely stood by and watched as so-called non-bank market-makers such as Flow Traders, Jump Trading and XTX Markets emerged as the leading price maker / takers across a number of categories and sectors in the equities, FX and listed derivatives asset classes.

The non-bank firms captured flow from the larger incumbents in those markets because – in addition to having an astute understanding of the mathematics and technology associated with algorithmic trading – they also succeeded in setting themselves up, in many cases, in manners akin to the large, disruptive, non-financial technology firms of the modern era such as Google or Meta. Using, in some instances, a single code base in which users can check in and immediately begin building new applications and toolkits for trading means that non-bank market-makers sidestep the siloed bureaucracy associated with Big Data – or very large dataset – projects in investment banks, for example.

Crucially, though, many of the leading-edge non-bank market-making businesses were built on quantitative analysis derived from public data or from semi-public data in cases where inputs from satellite imagery are used, for example. The use of this raw, but nonetheless recognisable, information means that it is easier for investors or traders to find it trustworthy as the fuel that fires successful, disruptive, quantum projects.

Much like a 3D printer, raw, unorganised, but nonetheless publicly available data is the raw material that allows algo model developers to take an existing problem for a trading business and create options for how it can be resolved in a variety of different ways. Once the data is cleansed and normalised, it can be fed into purpose-built applications to create new value for its users through a number of common e-trading use cases:

- Algo Trading – Using public data to enrich the inputs that required algorithmic trading strategies;

- Best Execution or transaction cost analysis;

- Voice & Electronic Flow Analysis and Market Share Derivation – Monitoring activity across distribution channels to track hit rates and other variables;

- Market Surveillance & Market Abuse Prevention – Using public transaction data as an input into different types of control frameworks; or in

- Strategic Market Structure Analysis – Tracking the evolution of liquidity parameters set by regulators in fixed income markets, for example, and then using those insights to predict future changes in liquidity parameters.

Understanding the Fixed Income E-trading Problem Statement

What Grandjean and the Propellant team understood when they began building their take on a market data service offering two years ago, is that the fixed income market – especially in the EU – is a special case. Since the birth of capital markets e-trading in the 1980s and, subsequently, its spread into every major asset class, there was always resistance within the fixed income trading industry, specifically, toward the idea of total electronification. At issue was both:

- Opacity – The historical nature of bonds and swaps trading processes and workflows, specifically, being overtly manual, OTC, RFQ-centric and specialised from one trading business to the next; and

- Instrument & Product Standardisation – With only two fundamental tradable financial instruments – bonds and derivatives – that offer three key characteristics in the form of price, duration / term and coupon that can then be used to create an exponential amount of execution parameters, meaning that exchange-based markets are still (relatively) innovative.

Underlying those two challenges, however, was an even more complex set of factors linked to the data created every time a bond is traded, namely:

- Buyside & Sellside Industry Interests – Bonds trading has famously been compared to playing a game of poker in that one side of the potential transaction never wants the other side to know its hand, and traders only strategically show their positions in a bond or fixed income fund when it is in their interests to do so; and

- Data Volume – Hundreds of thousands, if not millions, of bonds are traded per day, either individually or as instruments within funds or as packaged trades. Collecting, collating and making sense of all that information, globally, across every transaction that succeeds or fails is beyond even the scope of the most powerful supercomputer.

Efforts such as FINRA TRACE in the US to organise the volume of bonds trade data produced within just one regional marketplace in line with industry interests were noble; likewise efforts have to-date not been repeated in APAC or in EMEA.

The lack of any fully regulated fixed income consolidated tape anywhere, globally, is important as – arguably –bonds acted as a form of implosive dynamite during the onset of the 2008 financial crisis. Once the dust settled on the crisis, capital markets industry participants were left with several key changes to market structure – enforced by global regulatory standards – that specifically incentivise trade automation, electronification and large average daily volumes transacted, namely:

- Smaller Ticket / Trade Sizes – As investment banks reneged the scale of their historical role as market-makers or warehouses of bonds liquidity to comply with Basel capital requirement regulations;

- Post-trade Reporting – Especially in the EU, where it is now compulsory for both the buyside and the sellside to reveal their counterparties and deal sizes in a timely manner; and, because of these two factors

- The Growth of Passive Management – Incentivised by algo trading and bonds exchange-traded funds.

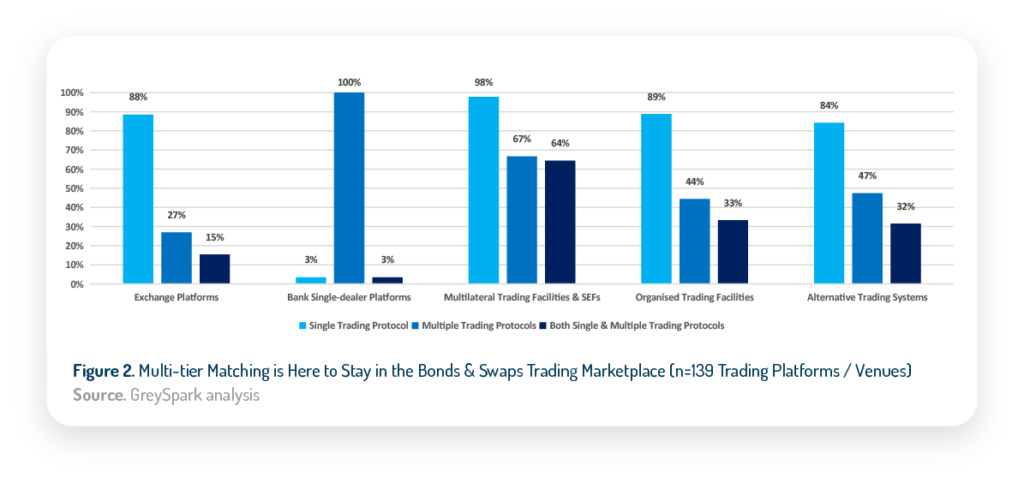

These structural changes in the fixed income marketplace are evidenced in 2023 by the increase observed in the variety of trading protocols offered by bonds and swaps trading platforms and venue operators globally to ease buyside and sellside participant ability to identify and act upon liquidity capture opportunities.

Where once two or three available trading protocols was the norm for any competitive fixed income e-trading platform or venue, increasingly three or four protocols are becoming the industry standard, with notable decreases observed in facilities offering five or six protocols since 2017 (see Figure 2).

GreySpark believes that overcoming these structural challenges means that, like all successful poker players, fixed income markets participants must now obtain the technological capacity to make sense of the trading activity taking place around them; to read the numbers and not just the counterparty and their assumed interests in one side of a transaction or the other. Therefore, the problem statement, in 2023, for bonds market data service providers like Propellant is no longer a case of:

- ‘There is not enough data to know what is going on;’ but rather it is

- ‘How can the data that is publicly available be transformed into actionable insights?’

The second article in this series will explore the means and the method that Propellant.digital used to tackle the Big Data project upon which its platform is based.