.png)

Bonds typically take the centre stage across the Fixed Income markets, with government bonds in particular leading the headlines when it comes to a macro focus. However, one hot topic at the recent Fixed Income Leaders Summit in Amsterdam was that the often forgotten cousin of a bond, the credit default swap (CDS) is soon to get a transparency makeover!

Both the FCA1 and ESMA2 are mandating the use of new information as part of the required trade reports, meaning it will be much easier to gain valuable insights into CDS liquidity from MiFID data.

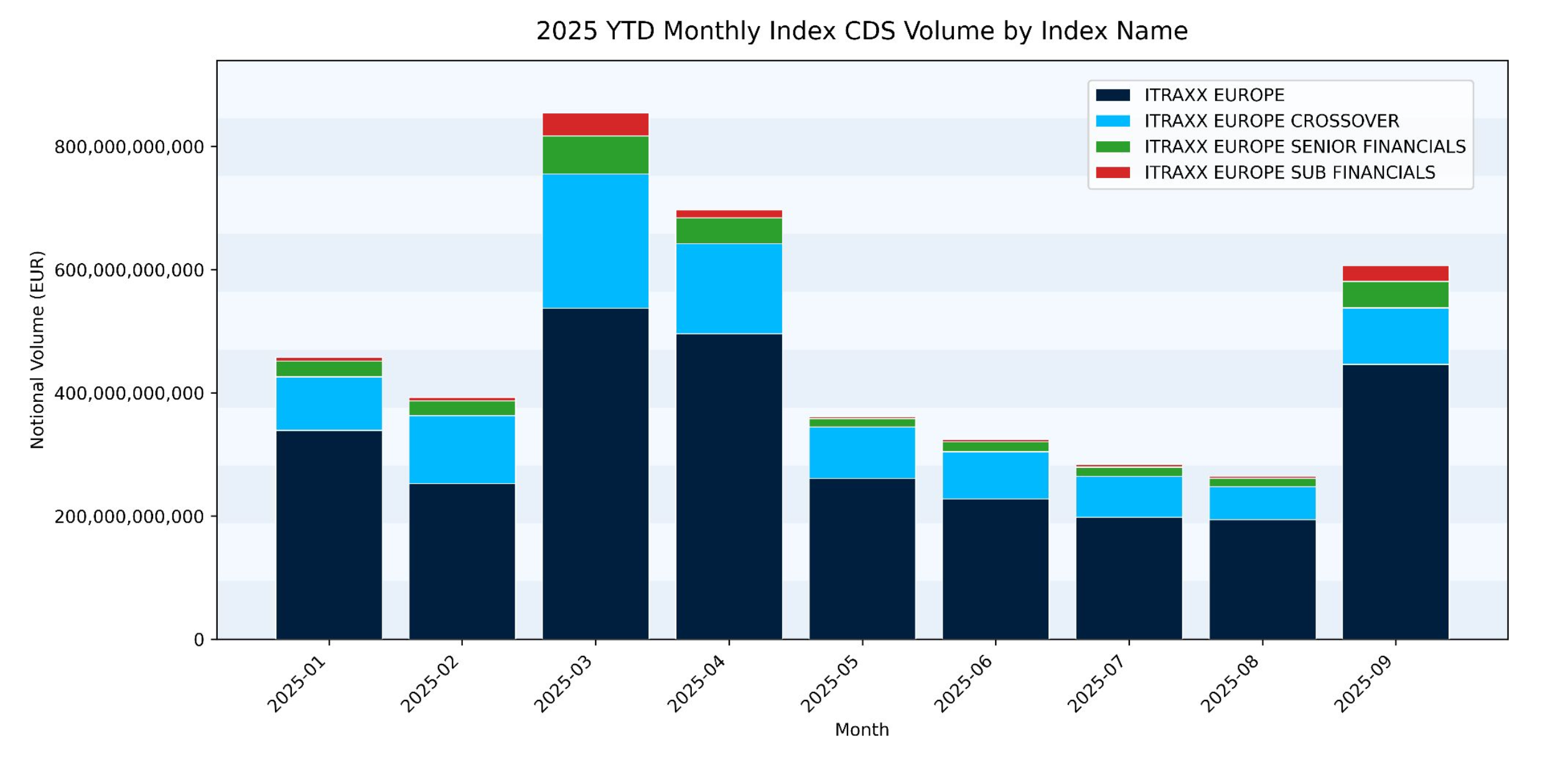

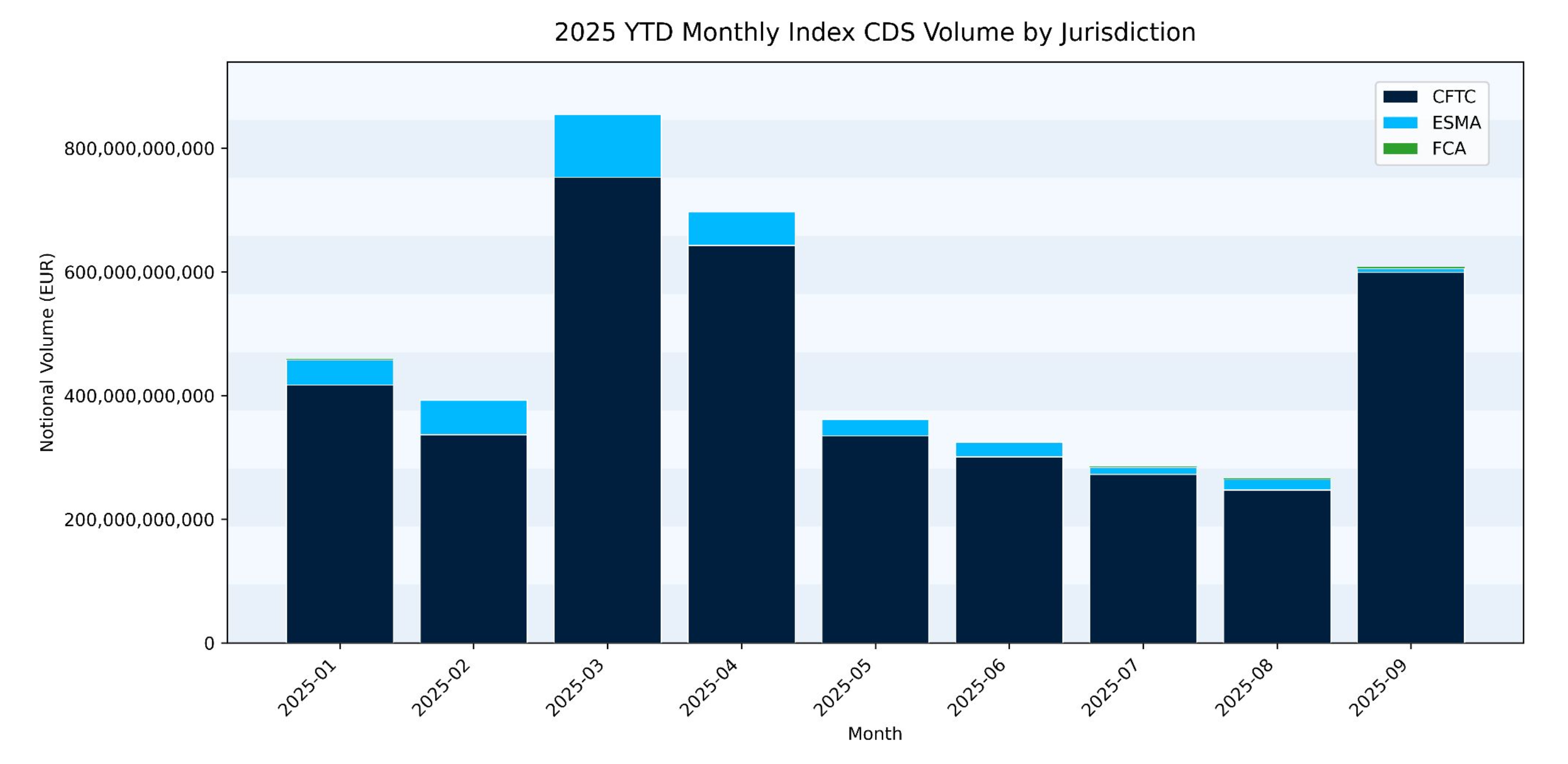

Firstly, let's focus on the main index family traded in Europe, the EUR-denominated iTraxx indices. The majority of activity occurs in iTraxx Europe (commonly known as ‘Main’), with the bulk of the remaining volume attributed to the Crossover series. What is particularly interesting about viewing this Index CDS data, is that a large percentage of activity is actually not reported via MiFID, but via Swap Data Repositories in the U.S.

Looking at the breakdown of the combined MiFID and DTCC dataset we can see that Index CDS volumes reported via DTCC overshadow those reported via ESMA (and even more so those reported via the FCA).

Whilst the upcoming changes to transparency aim to improve MiFID reporting for CDS (both single name and Index), in order to get a more complete picture, it is clearly important to consider the non-MiFID reporting venues too. Thankfully Propellant is able to help with this, as data published by DTCC can be added for existing users, with the additional U.S. Swap Data Repositories to be made available soon.