.png)

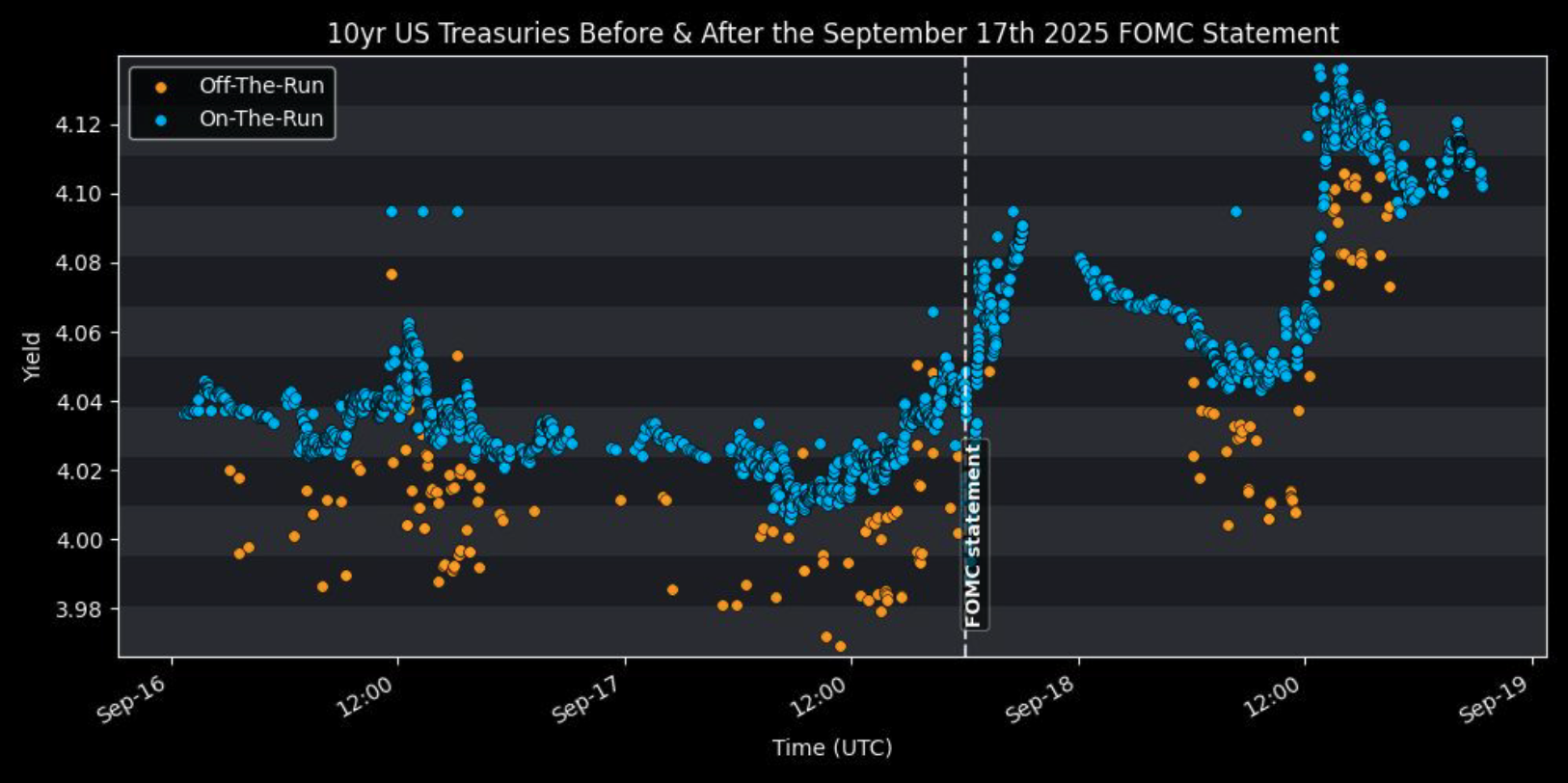

With the hotly anticipated FOMC announcement coming and going last week, with mixed sentiment in the bond markets, I thought it would be interesting to compare the reaction for on-the-run and the 2 closest off-the-run US Treasuries.

By using Propellant’s Analytics Suite*, I was able to quickly convert prices (reported under Europe’s MiFID regime) to yields and see the reaction around the announcement. As is often the case, there is a slight maturity mismatch, which partly explains the tighter yields for the off-the-run bonds; however the reaction was similar, if perhaps slightly more rapid, for the more liquid on-the-run bond.

What is particularly interesting, is the type of insight that can be gained from the MiFID dataset. We can see when looking more closely that, as expected, on-the-run volumes are far higher (particularly for the 10yr). However, the vast amount of volume, particularly for off-the-run activity, is traded off venue. These are voice trades, although due to reporting conventions this could include trades done via Alternative Trading Systems ‘ATS’.

With MiFID data, obtained via Propellant you can gain near real-time post trade data for US Treasuries and other Fixed Income securities streamed right to your device.

*Propellant's Analytics Suite is currently in Beta.